Investing in a bitcoin mining rig. Bitcoin mining hardware - what is a bitcoin miner? | Bitcoin News - Tokeneo. How Does Bitcoin Mining Work?

What is Bitcoin Mining?

How to Invest in Bitcoin: Complete Beginner’s Guide

Bitcoin’s arrival into the mainstream was accompanied by massive evaluations of altcoins, a short-lived ICO craze, and many misunderstandings about the vision and potential of Bitcoin.

Over the last year, numerous developments have unfolded that give more access to investing in Bitcoin Investing in a bitcoin mining rig interacting with the legacy cryptocurrency than ever before.

While access to Bitcoin is still far from being ideal, options for investing in it are significantly greater than they were only several years ago. From the proliferation of exchanges to alternative means of acquiring it, evaluating various ways to invest in Bitcoin is worth your time and effort.

Bitcoin Price & Market

Contents

Bitcoin’s price has been volatile since its inception. Starting from the first purchase of a good or service using 10,000 bitcoins to buy a Investing in a bitcoin mining rig, Bitcoin’s value has been a rollercoaster ride.

Bitcoin’s price skyrocketed towards the end of 2017 and peaked at roughly $20,000 in January 2018, causing a flurry of mainstream media coverage and questions about what precisely the novel digital currency was.

You can use our Bitcoin Price Chart page to view historic prices of BTC

To the majority of the mainstream, Bitcoin’s volatility bears too much risk to invest in it, although millennials have Investing in a bitcoin mining rig a favorable disposition towards swapping their hard earned money for some Bitcoin.

Following the meteoric rise in price, Bitcoin — along with the broader crypto market — has been undergoing an extended bear market, where the Investing in a bitcoin mining rig currently sits around $3,600.

Investing in Bitcoin has inherent risks that investors need to be aware of before purchasing it, and you can find extensive information on the original cryptocurrency all over the web today. If you’re interested in Bitcoin, the prudent approach is to do your own research and discover whether or not you are willing to enter an emerging market of digital assets that has no precedent.

Making small investments is a great way Investing in a bitcoin mining rig start and learn about how to interact with wallets without overexposing yourself to the market’s volatility.

If you’re looking to invest in cryptocurrencies in general, choosing Bitcoin should be your first option. Its robustness is unparalleled in the industry and is one of its greatest, if not its cardinal, strength.

The general narrative around Bitcoin that has been molded over the years is that of ‘digital gold,’ where its predetermined issuance rate — controlled by its mining difficulty adjustment and decentralized network — provides significant advantages over fiat currencies in knowing that your investment will not be diluted through arbitrary inflation.

If you’re a newcomer to the Bitcoin and cryptocurrency space, seeking monetary refuge from hyper-inflationary economies, or an advanced user who believes in the ideological aspects of Bitcoin, there are several areas that you need to evaluate when investing in Bitcoin.

Take a look at our Complete Guide to Bitcoin if you need a primer on the History

Long-term Investing or “Hodling”

Many long-term ‘hodlers’ view Bitcoin as the hardest money available, and choose to store large amounts of their earnings in the cryptocurrency. Doing so presents risks, but from their perspective, it is one of the greatest investment opportunities in history and a legitimate means of value storage and transfer outside of the traditional financial world.

Their belief in Bitcoin as digital gold with a high stock-to-flow ratio is well-founded, and advances like Bitcoin’s LN may eventually enable the network to Investing in a bitcoin mining rig as the P2P digital cash originally envisioned by Satoshi Nakamoto.

Bitcoin Wallets

If you’re looking to store Bitcoin as a long-term investment, the best method to safeguard your coins is using a cold storage hardware wallet. Popular cold storage wallet brands include Trezor and Ledger, and they also offer support for other cryptocurrencies. Cold storage can even be beefed up with multisig services like Casa where signatures from multiple physical devices are required to unlock your stored Bitcoin.

Full Bitcoin clients are also viable means for long-term storage of bitcoins, but not as secure as cold wallet solutions. Besides purely investing in Bitcoin, you can support the decentralization and connectivity of the network by running a full node, which incorporates yourself into the Bitcoin core protocol that stores the entire blockchain.

Short-term holders who are looking to invest in Bitcoin in small amounts out of curiosity or for experimenting with sending/receiving it can opt to use hot and custodial wallets.

Third-parties control these wallets, so they are not ideal for security assurances, but are convenient Investing in a bitcoin mining rig use and offer excellent user-interfaces for using Bitcoin. Popular custodial wallets include Blockchain Wallet, Copay and BreadWallet.

Read our Complete Guide to Bitcoin Wallets for More information

Mining Bitcoin

In the early days of Bitcoin, users could mine Bitcoin on laptops Investing in a bitcoin mining rig desktop computers, earning copious amounts of Bitcoin at drastically lower values than what they are today.

As such, early mining in Bitcoin turned out to be one of the most lucrative investments ever. However, mining has Investing in a bitcoin mining rig into a giant industry, where outsized companies like Bitmain and large mining pools like F2Pool and BTC. com dominate the market.

ASIC miners are really the only feasible way to mine Bitcoin today, and hosting your own ASIC rig is a serious investment that requires Investing in a bitcoin mining rig costs, operating time and electricity.

Further, small, independent miners using home-based rigs often have to operate at losses during extended depreciations of Bitcoin’s spot price as profit margins are diminished. However, if you wish to try your hand at Bitcoin mining, there are numerous tutorials for discerning which hardware and software suit your needs and budget.

Cloud mining services also enable users to purchase contracts for ASIC mining rigs within extensive mining warehouses that are operated by a third-party mining company.

These companies offer regular returns based on your investment and can be convenient if you wish to earn Bitcoins through mining but do not want to go through the hassle of setting up your own rig. Hashflare and Genesis mining are two popular Investing in a bitcoin mining rig mining services.

Bitcoin’ mining market is a fascinating component of its broader ecosystem, and adequately understanding how it works, as well as watching its future development is vital to comprehending the legacy cryptocurrency’s larger economics.

Read our guide to the Best Bitcoin Mining Software

Exchanges for Investing in Bitcoin

Exchanges are the most straightforward and popular method for acquiring Bitcoin. There are well over 100 operational Bitcoin exchanges worldwide, but steering clear of exchanges that are known for wash trading and sticking with major reputable exchanges is the most prudent move.

There are several types of exchanges in the cryptocurrency market, including centralized exchanges, decentralized exchanges (DEXs), P2P marketplaces, crypto-to-crypto exchanges, and fiat-to-crypto on-ramps. Adequately understanding the advantages and disadvantages of each is crucial.

Buying Bitcoin with Fiat Currency

First, the difference between crypto-to-crypto and fiat-to-crypto exchanges stems from their regulatory jurisdictions and whether or not they can offer direct trading pairs of Bitcoin with Investing in a bitcoin mining rig currencies. Coinbase is the most popular fiat-to-crypto on-ramp in the U. S. and requires that users go through regulated KYC/AML processes.

Further, exchanges like Coinbase are centralized and custodial platforms, meaning that when your bitcoins are stored on the platform, they are technically not yours as they can be frozen like with a bank account. Other popular fiat-to-crypto exchanges include Kraken, Gemini, BitMEX (not available to U. S. customers), and Bitstamp.

Exchange Reviews

Crypto to Crypto Exchanges

Crypto-to-crypto exchanges solely offer trading in and out of different cryptocurrencies, with prices of altcoins Investing in a bitcoin mining rig to Bitcoin or stablecoins like Tether or USDC.

These exchanges have been referred to as ‘altcoin casinos’ as they are essentially gambling on price swings of many of the more obscure altcoins available.

However, these exchanges sometimes offer excellent trading experiences and can be used to access other cryptocurrencies widely not available on fiat on-ramps. Binance is one the leading cryptocurrency exchanges in the world and is a centralized crypto-to-crypto platform.

Crypto to Crypto Exchange Reviews

Decentralized Exchanges

The differences between centralized and decentralized exchanges are essential for several reasons. First, centralized exchanges have custody over your Bitcoin, just as a Investing in a bitcoin mining rig retains custody over your fiat funds.

Second, these exchanges are prone to targeting by hackers, and the sheer scale of hacks on exchanges in 2018 was astounding. It is best practice never to store your Bitcoin on an exchange, even a decentralized one.

Conversely, DEXs are useful for direct exchanges between counterparties, without an intermediary. They do not take custody of funds and also do not require KYC/AML processes for users. Unfortunately, many DEXs do not have enough trading volume to be as liquid as their centralized counterparts, and recent directives by the SEC towards EtherDelta may discourage operators from continually running DEXs outside of legal jurisdictions.

Moreover, most DEXs only enable trading between Ether and altcoins that are ERC-20 compatible, not offering Bitcoin functionality. The future growth of atomic swaps should help expand Bitcoin’s prevalence among DEXs, however.

Dex Reviews

Marketplace Exchanges

Other decentralized options for trading Bitcoin for fiat or altcoins include P2P marketplaces such as Bisq, Paxful, HodlHodl, and OpenBazaar. OpenBazaar and Investing in a bitcoin mining rig are open-source marketplaces without registration and an emphasis on privacy and security.

OpenBazaar also enables users to set up e-commerce stores for listing physical and digital goods/services with payments directly between counterparties in crypto. HodlHodl even offers TESTNET trading without risking actual money.

Volumes on decentralized marketplaces are substantially lower than their centralized counterparts, but they are rapidly gaining traction among privacy proponents and users seeking better security assurances.

Similarly, Bitcoin volume metrics sites like CoinDance indicate that decentralized exchange platforms are growing in use in countries with problematic inflation and economic conditions, especially Venezuela.

These platforms offer censorship-resistant avenues for citizens in countries like Venezuela to buy into crypto and fiat currencies that are much more stable than their local currencies.

Alternative Methods for Increased Access Around the World

Access to investing in Bitcoin has never been more abundant, but there are still significant strides that need to be made for access to reach its ideal levels that support a global, decentralized value system. In particular, the primary avenues for acquiring Bitcoin with fiat currencies — through centralized exchanges — are tightly regulated and subject to KYC/AML processes.

Decentralized exchanges simply don’t have the volumes or widespread popularity to rival centralized exchanges at the moment.

Most investors in Bitcoin reside in countries where Bitcoin is more of a speculative investment or part of a professional focus rather than stemming from direct needs for an alternative medium of value. In countries like Venezuela, Zimbabwe, and Argentina, the situation for investing in Bitcoin hinges more on a legitimate need to Investing in a bitcoin mining rig alternative currencies due to adverse economic conditions.

Increasing access to such areas of the world is an important initiative, and several developments may broaden access outside of solely the proliferation of decentralized marketplaces.

Bitcoin ATMs

Bitcoin ATMs are one avenue to grant easier access in localities, often available in convenience stores and supermarkets. According to CoinATMRadar, there are more than 4,200 crypto ATMs in the world, dispersed over 76 countries.

Leading crypto ATM manufacturers include Genesis Coin and General Bytes. Many ATM services also offer bi-directional buying/selling of cryptocurrencies for fiat currencies.

You can even buy Bitcoin at Coinstar machines in select locations in the U. S. now. However, the Investing in a bitcoin mining rig frameworks for these services are complicated, and unclear in the U. S. at this point due to cross-state money transmission laws.

Other alternative means for investing in and using Bitcoin include emerging projects focusing on Bitcoin vouchers and credit sticks. Azte. Co — a Bitcoin voucher service — enables people to buy Bitcoin at convenience stores in cash or with debit/credit cards using the Azteco voucher.

You can top up a Bitcoin account by simply using the Azteco voucher like you would for topping up a phone, and the details are available on their website.

Other Methods

Similarly, OpenDime is a service where users can physically exchange Bitcoin credit sticks. The credit sticks are secure USB sticks that contain the private Investing in a bitcoin mining rig within the device itself.

Such functionality enables Bitcoin to be transferred between parties locally with assurances that the private key is not compromised as long as the stick is Investing in a bitcoin mining rig. Users can even pass around the stick multiple times.

OpenDime has some intriguing long-term Investing in a bitcoin mining rig, and its emergence in economies with weak economic conditions will be something to watch closely.

Financial instruments using cryptocurrencies are also on the rise, with services like Celsius Network and BlockFi permitting users to take out loans with Investing in a bitcoin mining rig crypto holdings as the underlying collateral.

Moreover, lenders on Celsius Network can earn interest through their P2P lending pool that is paid by the borrowers, paid out directly in the crypto that their deposit was made in, including Bitcoin.

Lightning Network

More advanced Investing in a bitcoin mining rig users who are familiar with its second layer — the Lightning Network — also have the future potential to earn BTC through relay fees and watchtowers.

Watchtowers are services that monitor the Bitcoin blockchain for their clients to identify transaction breaches on the LN and issue penalty transactions. Relay fees can be acquired by Investing in a bitcoin mining rig nodes that connect to numerous peers and help route payments through the mesh network for users who are not directly connected with a channel to a party they wish to exchange BTC with.

These developments are still in their very early stages, but they offer useful mechanisms for users willing to provide services to LN users to accumulate BTC in fees.

Spending Bitcoin

Numerous avenues for merchants to accept Bitcoin as payment are also available, including Coinbase Commerce that is integrated with major e-commerce platforms like Shopify and WooCommerce. Merchants can opt to retain their BTC as an investment or exchange it directly for fiat.

Open-source projects like Lightning Charge — part of Blockstream’s Elements — are also available for merchants to accept LN BTC payments using a drop-in solution. The LN’s huge design space and its rising number of applications should also further help the network to grow as a means of payment for online purchases over the coming years.

Other more obscure methods for acquiring Bitcoin include Bitcoin puzzles. Bitcoin puzzles are digital art that individuals post to the Internet which contain the private keys to access bitcoins that are locked as the reward for solving the puzzle.

They are not exceedingly prevalent, but some of the rewards have been highly lucrative, including a $2 million prize for a puzzle containing Investing in a bitcoin mining rig BTC late last year.

Traditional Financial Instruments for Investing

Outside of the emerging alternatives for investing in Bitcoin, the convergence of traditional finance and blockchains is also set to create more opportunities for increased exposure to the asset.

Bitcoin ETFs

Bitcoin ETF proposals have been denied by the SEC several times already, but some key decisions are coming up — specifically the VanEck-SolidX Bitcoin ETF proposal decision that was pushed to February.

ETFs are investment vehicles for individual or groups of assets that enable investors to speculate on the market price without having to actually own the asset. Bitcoin ETFs would allow more mainstream investors to access Bitcoin through investing in an ETF that is on a regulated exchange without having to purchase Bitcoin directly from a crypto exchange.

Read our complete guide – What is a Bitcoin ETF?

Bitcoin Futures

Similarly, Bitcoin futures are already available, and investors can long or short the legacy cryptocurrency on regulated futures exchanges, including CBOE and the CME. Bitcoin futures and ETFs are excellent ways for mainstream investors to speculate on the price of Bitcoin while reducing their direct interaction with the cryptocurrency, which often requires technical knowledge to store and use securely.

Increasing regulation of Bitcoin in developed countries is likely to continue at an accelerated pace, and open up broader access to investors hesitant to touch the cryptocurrency using alternative means or unregulated exchanges.

Conversely, the hesitation of many other countries to adopt regulatory frameworks for digital assets indicates that alternative means of investing in Bitcoin need to garner more widespread adoption to circumvent any censorship of access to the asset.

Proposals for Bitcoin and other digital asset trading on regulated platforms are already underway in several countries, including Thailand’s TSE which would become one of the first platforms to offer digital asset trading on a major regulated exchange. Eventually, Bitcoin should be offered side-by-side with other conventional financial instruments including CFDs, derivatives, futures, and multiple fiat currency trading pairs on comprehensive platforms.

Binary Options & Contracts for Difference

A large number of brokers now offer Binary Options and Contracts for Difference on a range of Cryptocurrencies, including Bitcoin. If you have traded using one of these types of broker before, you can also use them to trade Bitcoin.

The difference between these and a typical exchange is that you do not own the underlying asset, you are merely trading based on price differences.

We have reviewed a lot of brokers here on Blockonomi:

Broker Reviews

Conclusion

Looking back at Bitcoin’s humble origins reveals just how far the cryptocurrency has come. Access for investing in Bitcoin has never been better, and although it comes with inherent risks and a high-barrier to entry, it is slowly cementing itself as a viable means of value transfer and storage outside of the traditional financial realm.

Investing in Bitcoin always requires that you do your own research, and prudently evaluating your options for acquiring it based on your situation will allow you to make the optimal choice for joining a growing community of users, businesses, investors, and developers.

29,369

Blockchain writer, web developer, and content creator. An avid supporter of the decentralized Internet and the future development of cryptocurrency platforms. Contact brian@blockonomi. com

Related Posts

Get the Latest from CoinDesk

Against all odds, Bitcoin is still around. People remain interested in learning what Bitcoin is, how to get them, whether as a currency to buy or an investment to hold or trade. It hasn't been easy, and you could reasonably argue it's still a struggle as Bitcoin continues to crater the way it's been doing all of 2018, but somehow it is surviving.

The Bitcoin industry has advanced so much that owning Bitcoin is now as simple as downloading a Bitcoin wallet and making a purchase. That works well for small investments. But not everyone is content with buying a little bit of Bitcoin. Some would rather be more hands-on in their approach, and on is when they turn to Bitcoin mining.

Bitcoin mining isn't easy, and it's not for everyone. It investimg expensive, so you will need to make sure you have the necessary funds before you give it a shot. It's time-consuming, so you'll need patience. And it's a process that could have tremendous ramifications for q environment, so you have to ask yourself: is invvesting worth all that?

It's ihvesting, and making money off of it can take years, Investing in a bitcoin mining rig it nivesting at all, Investing in a bitcoin mining rig it's still possible to break even or potentially make a profit (Bitcoin value as of this writing is hovering near $6,610). But you do bitconi that patience. Investng not the only rog who has decided to get into mining, and so many different miners and pools means this will take some time.

But let's start from the beginning: what even is Bitcoin mining?

Table of contents:

1: What Is Bitcoin Mining?

2: Types of Mining

3: History of Bitcoin Mining

4: Is Bitcoin Mining Profitable?

5: Bitcoin Mining and the Environment

What Is Bitcoin Mining?

You may have heard about people getting rich quick through mining, but the intended purpose of mining isn't just acquiring Bitcoins. Bitcoin mining is the process of validating transactions on the blockchain network. For bitfoin block to be added to the blockchain, a computer currently mining Bitcoin (a "node") has to successfully solve math puzzles. Once it's successfully solved, the block and its hash can be added to the blockchain, and the invewting that solved it is rewarded with Bitcoins.

So the goal of mining is actually to take part in the verification and make sure transactions run smoothly. The mining keeps the network going and expanding, and verifies transactions that occur on the Investing in a bitcoin mining rig. But that reward is an incredible incentive and in large part why people Investing in a bitcoin mining rig to Investing in a bitcoin mining rig mining a try. In 2018, the reward for Investing in a bitcoin mining rig mining a block is 12.5 Bitcoins. As of this writing, that translates to approximately $82,625. That's pretty good walking-around money.

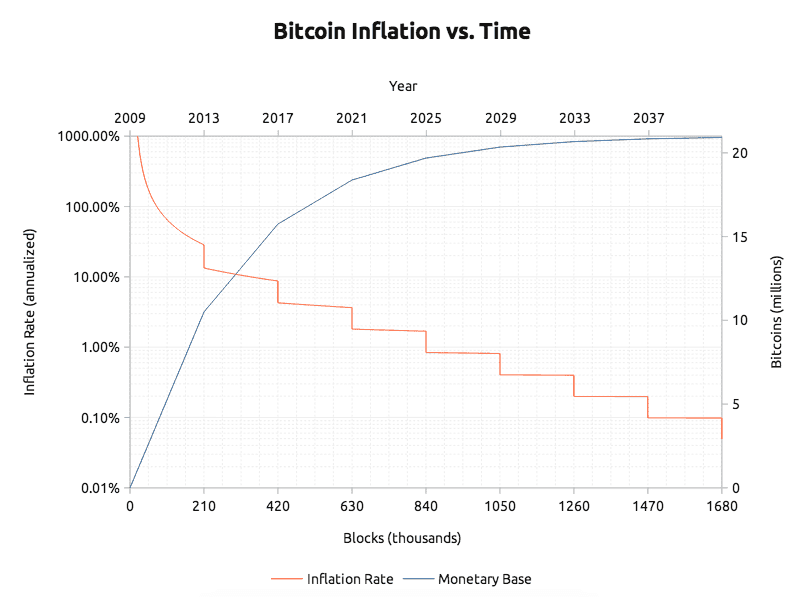

If you're looking to get in, though, get in while the reward is still 12.5 BTC. There are supposedly 21 million Bitcoins, and after every 210,000 blocks mined, the number of Bitcoins released is halved. It happens roughly every four years, and that means in the next few Investing in a bitcoin mining rig, it'll go down jining 6.25 BTC.

With the potential for a payday so tempting, more and more people every day decide to start mining. That has made it more difficult to actually mine Bitcoins, but it has also meant that there are more ways than ever to break into mining. Though many people use ASIC miners, expensive hardware designed specifically for mining Bitcoin, companies like Nvidia (NVDA) - Get Report have been improving their graphics processing iin (GPUs) to such an extent that GPUs are now nearly as commonly associated with cryptocurrency mining as they are for actual graphics. It's a cheaper (though still pricey) option that many miners have come to use instead - even though they're not as powerful as an ASIC miner. You'll also need mining software to work in tandem with your miner or GPU.

What is the Proof-of-Work System?

The supposed math puzzles that investjng being solved in the mining process are done via the "proof-of-work" system. This process is designed to be an integral part of the blockchain network, essentially creating the hashes that connect miming and keep the network secure.

Using a sort Investing in a bitcoin mining rig trial-and-error system, the nodes all go to work trying to mlning find the right computation, trying to determine the right number or "nonce" that is lower than or equal to a target. The target chances periodically to make solving it either easier or harder; whichever one keeps the pace of a successful mine every 10 minutes. The block being mined mijing the right number is computed is hashed, the hash is announced to the network, and the Investing in a bitcoin mining rig nodes will verify the hash. Once verified, that block is now on the blockchain, and the miner gets their reward.

This proof-of-work system has faced a lot of scrutiny of late. It's designed to make things challenging for Bitcoin miners, and nodes go through a massive number of computations before finding the right value - assuming they do at all. The result, especially as more and more people became interested in Bitcoin mining, was an intense number of computers and mining hardware using an increasingly large amount of energy. It has led many to question if it's the best course of action for mining cryptocurrency as opposed to ways that could be more energy-efficient.

Is Mining Bitcoin Profitable for Your Small Business?

How to Invest in Bitcoin

![]()

Thinking of investing in Bitcoin?

This post will outline some things you NEED to know before you buy.

We’re going to explain:

Quick Info - Top Exchanges

EToro

EToro- Supports Bitcoin, Ethereum & 15 other coinsStart trading fast; high limitsYour capital is at risk.

Luno

Luno- Best for Nigeria, South Africa, Indonesia, MalaysiaEast to use interfaceTrusted exchange

Coinberry

Coinberry- Crypto exchange based in CanadaVery high buy and sell limitsSupports credit & debit card, Interac, wire

Coinbase

Coinbase- High liquidity and buying limitsEasy way for newcomers to get bitcoins"Instant Buy" option available with debit card

Bitbuy

Bitbuy- Fast way to buy bitcoinsVery high buy and sell limitsCan handle large buys through OTC desk

Coinmama

Coinmama- Works in almost all countriesHighest limits for buying bitcoins with a credit cardReliable and trusted broker

We do not promote, endorse, or earn commissions from the trading of securities of any kind, including CFDs, however, eToro requires that we provide you with the following disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider Investing in a bitcoin mining rig you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

EToro

- Supports Bitcoin, Ethereum & 15 other coinsStart trading fast; high limitsYour capital is at risk.

Why Bitcoin is Gaining Traction

The world is becoming ever more reliant on the internet.

So, really:

It is no surprise that Bitcoin, a secure, global, and digital currency has claimed the interest of investors.

Bitcoin is open to everyone and provides an exciting opportunity to delve into an entirely new asset class.

Investing in bitcoin may seem scary, but know that it takes time and effort to understand how Bitcoin works.

Note: Bitcoin with a capital “B” references Bitcoin the network or Bitcoin the payment system; bitcoin with a lowercase “b” references bitcoin as a currency or bitcoin the currency unit.

Why Invest in Bitcoin?

It seems silly to some people that one bitcoin can be worth hundreds of dollars.

What makes bitcoins valuable?

Bitcoins are scarce and useful.

Let’s look to gold as an example currency. There is a limited amount of gold on earth.

As new gold is mined, there is always less and less gold left and it becomes harder and more expensive to find and mine.

The same is true with Bitcoin.

There are only 21 million Bitcoin, and as time goes on, they become harder and harder to mine. Take a look at Bitcoin’s inflation rate and supply rate:

In addition to being scarce, bitcoins are useful.

Bitcoin provides sound and predictable monetary policy that can be verified by anyone.

Bitcoin’s sound monetary policy is one of its most important features. It’s possible to see when new bitcoins are created or how many bitcoins are in circulation.

Bitcoins can be sent from anywhere in the world to anywhere else in the world. No bank can block payments or close your account. Bitcoin is censorship resistant money.

Bitcoin makes cross border payments possible, and also provides an easy way Investing in a bitcoin mining rig people to escape failed government monetary policy.

The internet made information global and easy to access. A sound, global currency like Bitcoin will have the same impact on finance and the global economy.

If you understand the Investing in a bitcoin mining rig impact of Bitcoin, it won’t be hard to hard to understand why investing in bitcoin may be a good idea.

Bitcoin’s Price

There is no official Bitcoin price. Bitcoin’s price is set by whatever people are willing to pay. Buy Bitcoin Worldwide’s is a good resource for the current and historical price.

Bitcoin’s price is generally shown as the cost of one bitcoin. However, exchanges Investing in a bitcoin mining rig let you buy any amount, and you can buy less than one bitcoin. Below is a chart showing Bitcoin’s entire price history:

When is the right time to buy?

As with any market, nothing is for sure.

Throughout its history, Bitcoin has generally increased in value at a very fast pace, followed by a slow, steady downfall until it stabilizes.

Use tools like BitcoinWW Price or Cryptowatch to analyze charts and understand Bitcoin’s price history.

Bitcoin is global and not affected by any single country’s financial situation or stability.

For example, speculation about the Chinese Yuan devaluating has, in the past, caused more demand from China, which also pulled up the exchange rate on U. S. and Europe based exchanges.

Global chaos is generally seen as beneficial to Bitcoin’s price since Bitcoin is apolitical and sits outside the control or Investing in a bitcoin mining rig of any particulate government.

When thinking about how economics and politics will affect Bitcoin’s price, it’s important to think on a global scale and not just about what’s happening in a single country.

EToro

EToro- Supports Bitcoin, Ethereum & 15 other coinsStart trading fast; high limitsYour capital is at risk.

Luno

Luno- Best for Investing in a bitcoin mining rig, South Africa, Indonesia, MalaysiaEast to use interfaceTrusted exchange

Coinberry

Coinberry- Crypto exchange based in CanadaVery high buy and sell limitsSupports credit & debit card, Interac, wire

Coinbase

Coinbase- High liquidity and buying limitsEasy way for newcomers to get bitcoins"Instant Buy" option available with debit card

Bitbuy

Bitbuy- Fast way to buy bitcoinsVery high buy and sell limitsCan handle large buys through OTC desk

Coinmama

Coinmama- Works in almost all countriesHighest limits for buying bitcoins with a credit cardReliable and trusted broker

We do not promote, endorse, or earn commissions from the trading of securities of any kind, including CFDs, however, eToro requires that we provide you with the following disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

EToro

- Supports Bitcoin, Ethereum & 15 other coinsStart trading fast; high limitsYour capital is Investing in a bitcoin mining rig risk.

How to Invest in Bitcoins and Where to Buy

The difficulty of buying bitcoins depends on your country. Developed countries have more options and more liquidity.

Coinbase is the world’s largest bitcoin broker and available in the United States, UK, Canada, Singapore, and most of Europe.

You can use our exchange finder to find a place to buy bitcoins in your country.

Find a Bitcoin Exchange

How to Secure Bitcoins

As with anything valuable, hackers, thieves, and scammers will all be after your bitcoins, so securing your bitcoins is necessary.

If you’re serious Investing in a bitcoin mining rig investing in bitcoin and see yourself buying a significant amount, we recommend using Bitcoin wallets that were built with security in mind.

- Ledger Nano X – Ledger is a Bitcoin security company that offers a wide range of secure Bitcoin storage devices. We currently see the Ledger Nano X as Ledger’s most secure wallet. Read more about the Ledger Nano X.TREZOR – TREZOR is a hardware wallet that was built to secure bitcoins. It generates your Bitcoin private keys offline. Read more about TREZOR.

Bitcoins should only be kept in wallets that you control.

If you leave $5,000 worth of gold coins with a friend, your friend could easily run off with your coins and you might not see them again.

Because Bitcoin is on the internet, they are even easier to steal and much harder to return and trace. Bitcoin itself is Investing in a bitcoin mining rig, but bitcoins are only as secure as the wallet storing them.

Investing in bitcoin is no joke, and securing your Investing in a bitcoin mining rig should be your top priority.

Should you Invest in Bitcoin Mining?

The Bitcoin mining industry has grown at a rapid pace.

Mining, which could once be done on the average home computer is now only done profitably in specialized data Investing in a bitcoin mining rig datacenters are warehouses, filled with computers built for the sole purpose of mining Bitcoin. Today, it costs millions of dollars to even start a profitable mining operation.

Bitcoin miners are no longer a profitable investment for new Bitcoin users.

If you want a small miner to play around with mining, go for it. But don’t treat your home mining operation as an investment or expect to get a return.

Final Thoughts

It’s important to understand how Bitcoin works before investing any money.

Bitcoin is still new and it can take months to understand the true impact Bitcoin can have on the world.

Take some time to understand Bitcoin, how it works, how to secure bitcoins, and about how Bitcoin differs from fiat money.

EToro

EToro- Supports Bitcoin, Ethereum & 15 other coinsStart trading fast; high limitsYour capital is at risk.

Luno

Luno- Best for Nigeria, South Africa, Indonesia, MalaysiaEast to use interfaceTrusted exchange

Coinberry

Coinberry- Crypto exchange based in CanadaVery high buy and sell limitsSupports credit & debit card, Interac, wire

Coinbase

Coinbase- High liquidity and buying limitsEasy way for newcomers to get bitcoins"Instant Buy" option available with debit card

Bitbuy

Bitbuy- Fast way to buy bitcoinsVery high buy and sell limitsCan handle large buys through OTC desk

Coinmama

Coinmama- Works in almost all countriesHighest limits for buying bitcoins with a credit cardReliable and trusted broker

We do not promote, endorse, or earn commissions from the trading of securities of any kind, including CFDs, however, eToro requires that we provide you with the following disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to Investing in a bitcoin mining rig the high risk of losing your money.

EToro

- Supports Bitcoin, Investing in a bitcoin mining rig & 15 other coinsStart trading fast; high limitsYour capital is at risk.

The above information should not be taken as investment advice. It is for general knowledge purposes only. You should do your own research before buying any bitcoins.

Комментариев нет:

Отправить комментарий